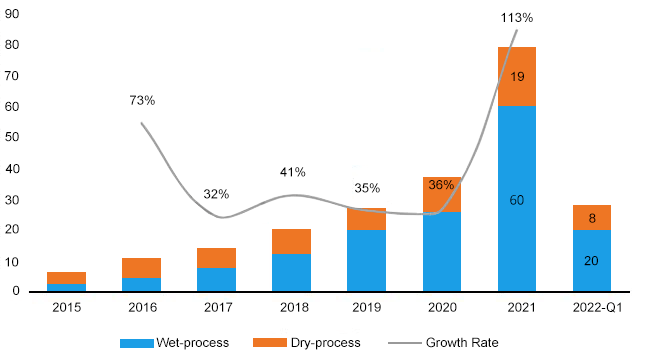

In 2021, China’s total shipment volume of lithium ion battery separator reached 7.9 billion square meters. The compound growth rate was about 54% in the past six years. The global battery separator shipment was 10.7 billion square meters in 2021. And the China mainland market accounted for 73.8% of the worldwide market share, which has an increase of 15% compared to 2020.

In the first quarter of 2022, the national shipment capacity reached 2.8 billion square meters, equivalent to 35% of the shipments in 2021. A year-on-year increase of 135%. The SPIR predicts that China’s lithium battery separator shipments will exceed 10 billion square meters in 2022.

2015-2022 Q1 Shipment of China Battery Separator (billion square meters) and Growth Rate

The development trend of the battery separator industry:

1) Wet process separator is the mainstream technical route, and the dry process battery separator is mainly used in energy storage and low-end electric vehicles.

2) The technical thresholds for battery separators are the highest among the four primary materials of battery production. It has a long production expansion cycle and the most substantial profitability. In the next 4 years, the profits capability of leading companies will continue to grow.

3) The supply of battery separators is a bit tight in 2022, and the price of battery separators in Q1 rose slightly.

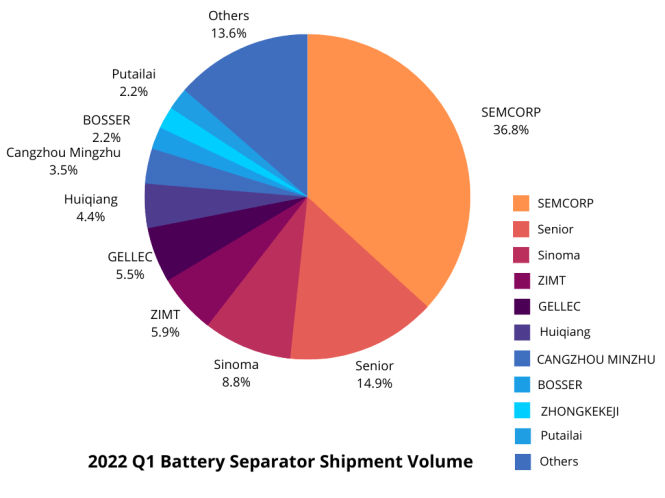

The top 10 companies in Q1 battery separator shipments in 2022 are as follows.

- SEMCORP

- SENIOR

- SINOMA

- ZIMT

- GELLEC

- HUIQIANG

- Cangzhou Mingzhu

- BOSSER

- GREEN ZHONGKEKEJI

- PUTAILAI

The total market share of the above companies has reached 86.4%.

The market shows us a “1 super + 2 strong + multi small” pattern from the competition perspective. SEMCORP (wet process) is still the leading player in the battery separator industry.

In 2022, Q1 battery separator shipments were 1.07 billion square meters, with a market share of 36.8%. Senior material (dry process + wet process) had a shipment volume of 360 million square meters in Q1 in 2022, with a market share of 14.9%, ranking second.

Among the top 10 separator manufacturers, Sinoma has been ranked third with solid ability in the past two years. The top three in the diaphragm industry still face challenges from 4-10 other battery separator companies.

In general, the companies at the top of the diaphragm industry pyramid are fixed, but the middle and bottom of the pyramid are still in severe competition.

SEMCORP

SEMCORP, formerly known as Yunnan Innovation New Materials Co., Ltd., was established on April 5, 2006. SEMCORP is mainly engaged in lithiumion battery separators, paper, printing, BOPP film, and other businesses.

As one of the world’s largest wet-process lithium battery separator manufacturers, it was successfully listed on the Shenzhen Stock Exchange in September 2016.

The company’s main products include 5µm to 30µm wet-process battery separators; ceramic, polymer, or functional coating film products. Its customers include China’s top 10 lithium battery manufacturers, foreign first-class battery companies, and car companies, such as CATL, LG, CALB, BYD, etc.

Q1 Shipment of lithium ion battery separator

In 2021, SEMCORP achieved a sales revenue of 7.98 billion yuan, an increase of 86%. And the net profit attributable to the parent company is 2.72 billion yuan, a rise of 143%.

The total shipment volume in 2021 is 2.87 billion square meters. The Q1 shipment capacity in 2022 is about 1.1 billion square meters, more than 1/3 of the shipment volume in 2021, accounting for 36.8% of the separator market share and 48.8% of the wet-process battery separator market share. It is a leading player in the separator market in China.

With the increasing market demand, the demand for SEMCORP membrane products will exceed its supply in the next 2-3 years.

Production Capacity

To improve its supply capacity, at the end of 2021, SEMCORP has built a battery separator production line of 5 billion square meters, including 4.2 billion square meters of the wet-process base film and about 800 million square meters of wet coating.

In 2022, 25-30 new production lines are expected to be put into operation gradually. Therefore, SEMCORP’s production capacity will reach 7.5-8 billion square meters per year.

At the same time, SEMCORP actively expands overseas markets and enhances its oversea supply capacity. They are expected to put the Hungarian production facility into operation in 2023. The Hungarian production facility has a production capacity of 400 million square meters of wet process membranes.

As production capacity climbs, the company’s annual battery separator shipments will reach 4.5-5 billion square meters per year, increasing more than 50% compared with 2021.

SENIOR

Shenzhen Senior New Material Technology Co., Ltd. was established in September 2003, focusing on new energy and new materials, and is a leader in the battery separator industry.

Listed on the Shenzhen Stock Exchange in December 2016, Senior’s products cover lithium battery dry process base film, wet process base film, and coated separators. It has become a battery separator company with the widest variety of products and the best quality in the global industry.

Principal customers include LG, CATL, BYD, and Gotion Hi-Tech. Since 2013, its products have been exported to LG Chem and other overseas customers. It is the first Chinese company to achieve zero breakthroughs in exporting lithium battery separators.

Q1 Shipment of lithium ion battery separator

Senior’s sales revenue is 1.861 billion yuan in 2021, up 92%. The net profit attributable to the parent company is 283 million yuan, up 133%.

The total shipment volume in 2021 is 1.120 billion square meters, and the Q1 shipment in 2022 is about 370 million square meters. It is the same as Q4 in 2021, accounting for 14.9% of the separator market share (21.7% dry-process and 13.1% wet-process).

Production Capacity

Senior’s headquarters is located in Shenzhen. Its three other major production bases are located in Anhui, Jiangsu, and Europe. Senior also established R&D centers in Shenzhen, Osaka, Japan, and Germany.

Senior’s production capacity reached 1.6 billion square meters in 2020 and 1.9 billion square meters in 2021, including 600 million square meters of the dry-process base film, 400 million square meters of dry-process coating, 350 million square meters of the wet-process base film, and 550 million square meters of the wet-process coating film.

According to the company’s strategic plan, the company will have an annual production capacity of 6 billion square meters of base films and 4 billion square meters of coated separators by 2025.

SINOMA

Sinoma was established in 2001 and was listed on the Shenzhen Stock Exchange in 2006. Sinoma’s business includes wind power blades, composite materials, glass fiber, and battery separators. Their main products are 7-16μm wet-process separators and ceramic coating separators.

Sinoma’s battery separators are approved by many medium and high-end lithium battery manufacturers worldwide for their excellent performance. The main customers include CATL, BYD, ATL, LG, etc.

Q1 Shipment of lithium ion battery separator

Last year, Sinoma the company achieved a revenue of 20.2 billion yuan. In the first quarter of 2022, Sinoma earned a profit of 4.662 billion yuan, a gain of 15.9%. The net profit attributable to the parent is 734 million yuan, increasing 24.5%.

Sinoma’s battery separator shipment volume in 2021 is about 680 million square meters. The Q1 shipment in 2022 is about 290 million square meters, accounting for 8.8% of the diaphragm market share, mainly 12.1% of the wet process diaphragm market.

Production Capacity

By the end of 2021, the production capacity of Sinoma has reached 1.04 billion square meters, including 680 million square meters of the wet-process base film and 360 million square meters of wet coating separators.

In the meantime, Sinoma is building a new plant in Tengzhou Shandong. The new plant is expected to produce 2.64 billion square meters per year. The first phase of this project includes a 200 million square meter production line and a 40 million square meter coating production line. This new plant will bring Sinoma a new profit growth.

ZIMT

Founded in 2012, ZIMT is a high-tech enterprise engaged in the lithium-ion battery separator business. Their significant customers include BYD, Penghui, ZTE Paineng, Phylion, etc.

On April 11, ZIMT was involved in a legal dispute over the Senior’s invention patent rights and was requested to stop immediately infringing the invention patent rights.

Q1 Shipment of lithium ion battery separator

In 2021, the company’s shipment volume was about 370 million square meters, mainly including dry process base film and coating separators.

In 2022, the Q1 shipment volume is about 170 million square meters, accounting for 5.9% of the battery separator market share and 19.5% of the dry-process battery separator market. It is also one of the leading companies in the dry-process membrane industry.

Production Capacity

By the end of 2021, the production capacity of ZIMT has reached 1.3 billion square meters, including 1.2 billion square meters of dry-process battery separators and an annual production capacity of 150 million square meters of coated separators.

ZIMT has high-level manufacturing bases both in Shenzhen and Wuhan. Last year, ZIMT began to build the second-phase project in Wuhan. Their production capacity will significantly increase after the project is put into production.

GELLEC

Established in 2010, Gellec is an enterprise integrating R&D, production, and sales of lithium battery wet-process separators. Gellec has applied for 230 patents for lithium-battery separator manufacturing so far.

Gellec is also certified by ISO9001, ISO14001, ISO45001, IATF16949, GB/T29490, and other battery separator-related standards. Gellec made its initial public offering and went public On April 19. Their significant customers include Yiwei Lithium Energy, Gotion Hi-Tech, Ruipu Energy, and Weihong Power.

Shipment Volume

In 2021, the company’s wet process base film and coating battery separator shipments were about 410 million square meters. However, Q1 shipments in 2022 were about 130 million square meters, which exceeds 30% of the shipment volume of the entire year of 2021.

Gellec’s shipment volume in Q1 occupied 5.5% of the battery separator market share and accounted for 7.5% of the wet-process battery separator market. Gellec represents the second-tier enterprises in the battery separator industry.

Production Capacity

So far, Gellec has three production bases in Hebei, Anhui, and Tianjin. In 2021, the production capacity was 1.1 billion square meters, including 750 million square meters of wet-process base film and 350 million square meters of wet coating.

In 2022, the production capacity will increase by 2.05 billion square meters per year and a total capacity of 6.1 billion square meters per year.

HUIQIANG

Founded in 2011, Huiqiang New Energy is a high-tech enterprise focusing on research, development, production, and sales of high-quality lithium-ion battery separators. Their main products include 6μm to 60μm monolayer, multi-layer, and coated battery separators. Their significant customers have BYD, Histar, Penghui, Phylion, etc.

Shipment Volume

In 2021, Huiqiang’s dry-process and wet-process battery separator shipments were about 320 million square meters. And its shipments in 2022 Q1 were about 160 million square meters, close to 50% of the entire year of 2021. Their business capacity has been dramatically improved, accounting for 4.4% of the battery separator market share and 12.1% of the wet-process battery separator market.

Production Capacity

Huiqiang has three manufacturing bases and two provincial-level special membrane R&D centres in Henan, Hubei province.

In 2021, their production capacity reached 730 million square meters per year, including about 600 million square meters of the dry-process base film, 30 million square meters of the dry-process coated film, and about 100 million square meters of the wet-process base film.

On April 6, Huiqiang New Materials started the lithium battery intelligent battery separator project’s second phase. This project will be completed in August 2022 and will add 400 million square meters of production capacity per year.

CANGZHOU MINZHU

Established in 1995, Cangzhou Mingzhu is located in Cangzhou City, Hebei Province.

As one of China’s earliest companies engaged in the lithium battery separator business, Cangzhou Mingzhu’s primary business is PE pipes, BOPA films, battery separators, composite piping systems, etc. Their lithium battery separator products mainly include the lithium battery dry method, wet method separator, and coated separator.

Cangzhou Mingzhu is also highly competitive in the dry process battery separators. On January 24, 2007, Cangzhou Mingzhu (stock code: 002108) was listed on the Shenzhen Stock Exchange. Their main customers include BYD, CALB, BAK, Lishen, Penghui, etc.

Shipment Volume

In 2021, Cangzhou Mingzhu gained revenue of 3.12 billion yuan, an increase of 12.9%, and a net profit attributable to the parent of 450 million yuan, an increase of 50%. In 2021, the company’s total battery separator shipments were about 260 million square meters.

In 2022, their Q1 shipments were almost 90 million square meters, accounting for 3.5% of the battery separator market share.

Production Capacity

By 2021, the total production capacity of the company’s diaphragms were about 300 million square meters, including about 100 million square meters of the dry-process base film, 50 million square meters of dry coating, about 200 million square meters of the wet-process base film, and 80 million square meters of wet coating.

This year, Cangzhou Mingzhu will expand its production capacity by 200 million square meters, and it is expected that the total production capacity will reach more than 500 million square meters in 2022.

BOSSER

Established in 2015, Bosser is a high-tech enterprise engaged in researching, developing, and producing lithium-ion battery separators.

Bosser’s main products are dry uniaxial stretching, single-layer battery separator, multi-layer composite battery separator, single- and double-layer coating (water-based ceramic), and double-layer PVDF single-layer ceramic coating + double-layer adhesive coating battery separator. Significant customers include Highpower Technology, Tianmao, COSMX, etc.

Shipment Volume

In 2021, BOSSER’s battery separator shipments were about 180 million square meters, and Q1 shipments in 2022 were almost 60 million square meters, accounting for 3% of the battery separator market share.

Until 2021, Bosser already had 6 lithium-ion battery separator production lines and 6 coating production lines.

Production Capacity

And its annual production capacity is 200 million square meters per year, including about 100 million square meters of the dry-process base film and about 100 million square meters of dry coating.

At the same time, in April 2021, Bosser invested 1.5 billion to build a new manufacturing base in Yandu District, Yancheng City, Jiangsu Province. This new plant has 20 new-generation battery separator production lines. Therefore, Bosser’s production capacity in 2022 will exceed 500 million square meters.

ZHONGKEKEJI

Founded in 2002, ZHONGKEKEJI is a high-tech enterprise specializing in R&D, production and sales of lithium battery separators.

With the modern production base, research and development facility, testing equipment, and a clean workshop, ZHONGKEKEJI can manufacture dry-process, wet-process, and coated battery separators.

Their products are also widely used in new energy fields such as power, energy storage, digital products, etc. ZHONGKEKEJI’s primary customers include COSMX, Sinopoly, Far East Battery, PYLON, etc.

Production Capacity

In 2021, the shipment volume of ZHONGKEKEJI was about 160 million square meters.

Their Q1 shipments in 2022 were almost 60 million square meters, accounting for 3% of the battery separator market share. It is expected that the production capacity of ZHONGKEKEJI will reach 300 million square meters in 2022.

PUTAILAI

Established in 2012, Pulaitai is mainly engaged in three major businesses, negative electrode materials for lithium-ion batteries, automatic process equipment, and lithium battery separators (particularly coating and processing). Their main product is coated battery separators.

Production Capacity

In 2021, the company’s wet coating shipments volume was about 160 million square meters, and Q1 shipments in 2022 were almost 50 million square meters, accounting for 3% of the diaphragm market share.

In 2021, the market share of the company’s coated battery separators reached 35.19% (coating and processing), including 100 million square meters of base film, 80,000 tons of nano-alumina, and boehmite, 5,000 tons of PVDF, and 4 billion square meters of coated battery separators processing capacity.

Putailai currently has a planned total production capacity of 8.7 billion square meters per year.