Power lithium battery or lithium car battery refers to a rechargeable system dedicated to electric vehicles and provides power sources. As one of the core components of EVs, power batteries directly affect the EV range, safety, service life, charging time, and temperature adaptability. Overall, the demand for power batteries has risen to a record-high, benefitting from the growing electric vehicle market.

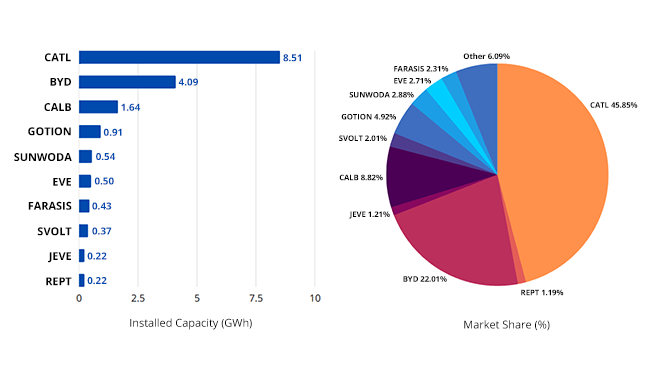

In May, affected by the surge in domestic sales of electric vehicles, the installed capacity of power batteries also increased significantly. Thirty-seven power battery companies in China’s new energy vehicle market achieved vehicle installation in May, a decrease of 4 from last year. CATL, BYD, CALB, GOTION, and SUNWODA are still in the top five.

EVE surpassed SVOLT, ranked sixth. FARASIS ENERGY rose to seventh, SVOLT dropped to eighth, JEVE rose to ninth, and REP Tranked tenth.

2022-05 Top 10 Power Battery Companies' Installed Capacity & Market Share in China

Lithium battery Industry Competition Pattern

The competition pattern of China’s power battery industry is mainly concentrated, and leading companies are continually contending for their market share. It is worth noting that the market share of CATL has risen sharply again, rising by 7.5 percent to 45.85% in May.

In contrast, BYD’s market share fell by 10.2 percent to 22.01% in May. CATL, which occupies almost half the market share, has undoubtedly become a giant in the battery industry by its scale and technological advantages.

In the future, it’s more likely the situation that the strong will get stronger. From the installed capacity view, the top 10 Chinese power battery companies in May are as follows.

- Contemporary Amperex Technology Co., Ltd. (CATL)

- BYD Company Ltd. (BYD)

- China Lithium Battery Technology Co., Ltd. (CALB)

- Gotion High-Tech Co.,Ltd. (GOTION)

- Sunwoda Electronic Co., Ltd. (SUNWODA)

- EVE Energy Co., Ltd. (EVE)

- Farasis Energy(GanZhou)Co., Ltd (FARASIS)

- SVOLT Energy Technology Co., Ltd (SVOLT)

- Tianjin EV Energies Co., Ltd. (JEVE)

- REPT Battero Energy Co., Ltd. (REPT)

CATL

–Established: 2011

As one of China’s first power battery manufacturers with international competitiveness, CATL focuses on developing, researching, producing, and selling electric vehicle(EV) battery systems and energy storage systems. On June 11, 2018, CATL went public on China Stock Exchange Growth Enterprise Market.

In addition, CATL also has core technical advantages and sustainable R&D capabilities in lithium battery recycling. According to the Analysis and Forecast of China’s Lithium Battery Recycling, China’s Li-ion Battery Recycling market will reach 2.31 million tons in 2026.

Its subsidiary has the production capacity to recycle 120,000 tons of lithium batteries annually. Hunan Bangpu, a subsidiary of CATL, mainly engages in battery, automobile, and new material cycling.

In 2021, CATL’s total production capacity was 170.39GWh. In May 2022, CATL continued to dominate the market with an installed power battery capacity of 8.51 GW, and its market share rose to 45.85%. Until now, CATL has been the world’s largest power battery company for five consecutive years.

CATL has established cooperative relations with many domestic brand car makers and has successfully occupied a place in the global market. It is also the first domestic lithium-ion power battery manufacturer to enter to supply top international car companies. The main customers of CATL include BAIC, BMW Brilliance, Geely, FAW, CSR Times, Xiamen Jinlong, Zhengzhou Yutong, Zhongtong Bus, etc.

BYD

Established: 2006

As a former domestic consumer battery veteran, BYD started with the nickel-cadmium battery business in 1995 and entered the field of lithium-ion battery production in 1998. BYD shifted the battery business to vehicle power batteries in 2010.

Today, BYD is the second largest manufacturer in the power lithium battery industry. It is reported that BYD’s production capacity was 135GWh by the end of 2021 and expecting to reach 285GWh and 445GWh in 2022 and 2023, respectively. In May 2022, BYD’s power battery installed capacity was 4.09GWh, with a market share of 22.01%.

From corporate positioning of view, BYD initially focused on building new energy vehicles, while power batteries adopted a self-produced and self-installed model. Thus, more than 90% of its lithium batteries are going to its electric vehicles factory, and the external supply is relatively small.

Since 2019, the BYD lithium battery department has begun cooperating with other vehicle manufacturers such as Changan Automobile, Zoomlion, Zhongtian Hi-Tech Jinkang Automobile, Longma Sanitation, Beijing Tianlutong, BAIC, FAW, Dongfeng, and Changan Ford.

CALB

Established: 2015

CALB, formerly known as AVIC Lithium, is an old-brand power battery enterprise established by AVIC Corporation. Compared to CALB, CTAL is a young player in the power battery industry.

According to data from the China Automobile Power Battery Industry Innovation Alliance, in 2021, the total installed capacity of CALB was 9.05GWh, ranking third after CATL and BYD with a 5.9% market share. In May 2022, the cumulative installed capacity of CALB was 1.64GWh, accounting for 8.82% of the market, still ranking third.

Currently, CALB has become the largest battery supplier of GAC Aion – CALB’s key customer. However, before 2020, CATL has been the leading battery supplier of GAC Aion. Until now, CALB also supplies power batteries for many auto brands such as Dongfeng, Changan, Geely, and Xiaopeng, which are also valued customers of CATL.

GOTION

Established: 2001

Gotion was jointly established by Zhuhai Gotion Trading and Hefei Gotion Marketing. Despite its primary product LFP power batteries, Gotion’s product also includes LFP cathode materials, battery core, BMS, and lithium battery PACK.

Gotion’s current production capacity is about 28Gwh, mainly square and cylindrical power batteries. In May 2022, Gotion had a total installed capacity of 0.91GWh, ranking fourth with a 4.92% market share.

Currently, the main customers of Gotion include Nanjing Jinlong, Jianghuai Automobile, Ankai Bus, Zoomlion, Shanghai Sunwin, Dongfeng Motor, Hebei Yujie, etc.

SUNWODA

Established: 1997

As one of China’s first companies to produce lithium-ion battery modules, Sunwoda’s products cover 3C consumer batteries and electric vehicle power batteries. Sunwoda began to march the power batteries industry in 2008.

According to the statistics of “QIDIAN Lithium Battery,” by the end of 2021, the production capacity of Sunwoda’s power batteries has exceeded 10GWh. By 2025, its production capacity is expected to reach 138GWh. This May, Sunwoda also achieved great success in the power battery market with a total installed capacity was 0.54GWh, accounting for 2.88% of the market, ranking fifth.

In terms of customers, Sunwoda has established cooperative relationships with brand car makers, including Renault, Nissan, Easyjet, Geely, Dongfeng, GAC, SAIC-GM-Wuling, and SAIC Passenger Cars, etc.

EVE

Established: 2001

EVE Energy Co., Ltd. (EVE) went public on Shenzhen GEM in 2009. After 21 years of growth, it has become one of the significant competitors in the Li-ion battery industry.

Currently, the power battery production capacity of EVE is about 11GWh, including a 4.5GWh LPF battery, 3.5GWh cylindrical battery, 1.5GWh prismatic battery, and 1.5GWh pouch battery. According to public data, in May 2022, EVE achieved a total installed capacity of 0.5GWh of power batteries, accounting for 2.71% market share, ranking sixth in the industry.

Compared with battery giant CATL and BYD, the production capacity of EVE is tiny. However, EVE is not focused on meeting all car manufacturers’ needs but on using its technology to serve customers well. Until now, EVE’s customers mainly include Daimler, Ford, Hyundai, Kia, etc.

FARASIS

Established: 2009

As one of China’s first companies to mass-produce pouch batteries for electric vehicles, FARASIS is a “dark horse” of lithium power batteries. Moreover, FARASIS is one of the few domestic companies that can mass-produce high-nickel ternary batteries.

In the future, with the overproduced low-end battery flooding the market, the demand for high-end batteries will continue to grow. Therefore, FARASIS’s differentiation advantage on high-end batteries will gradually become prominent.

The production capacity of FARASIS’s power battery is expected to reach about 13GWh this year. FARASIS announced a total installed capacity of 0.43GWh of power batteries in May 2022, ranking seventh in the industry with a market share of 2.31%.

According to the company’s previous announcement, FARASIS has received many orders from major customers. In 2022, the company’s handheld orders are about 14.81GWh, more than 9 times the shipment volume from January to February. Up to now, in addition to Daimler, FARASIS’s customers include Beijing Benz, GAC Aeon, FAW, Geely, Dongfeng, Tianji, Jiangling, Mitsubishi, and many other brand car makers.

SVOLT

Established: 2018

Formerly known as the predecessor of the power battery division of Great Wall Motors, SVOLT’s business scope covers R&D and manufacturing of power battery core materials, cells, modules, PACK, BMS, energy storage, and solar energy.

According to official data, SVOLT will deploy a production capacity of 297GWh in China and a 30GWh production capacity in Germany.

In May 2022, SVOLT’s total installed capacity of power batteries is 0.37GWh, implying for 2.01% market share, ranking eighth in the industry.

In addition to the stable supply of power lithium batteries for self-owned brand vehicles, SVOLT has continuously won the favor of external customers such as Stellantis Group. According to SVOLT, by December 2021, the company has secured more than 30 project designations with car makers, including brands such as Great Wall, Dongfeng, FAW, Geely, Hezhong New Energy, Celis, and Leapmotor.

JEVE

Established: 2009

JEVE aims to provide green, safe, intelligent energy storage solutions worldwide. Its products include BEV, PHEV, HEV/48V, and LTO. JEVE possesses a full-featured trial production test platform and software platform to meet the needs of the entire product development process, from raw materials, batteries, and BMS to systems.

As one of the earliest companies to deploy lithium battery production in China, JEVE proposed a production capacity target of 100GWh power battery in 2025. In terms of installed capacity, from 2021, JEVE has become a member of the TOP 10 club in China. In May 2022, JEVE achieved a total installed capacity of 0.22GWh, accounting for 1.21%, ranking tenth in the industry.

In February this year, Chery New Energy and JEVE signed a strategic cooperation agreement. Chery New Energy plans to purchase power batteries with a total amount of 5 billion RMB from JEVE in the next three years. In addition to Chery, Great Wall Motor, Hezhong New Energy, Dongfeng Motor, etc., are also deepening cooperation with JEVE in battery supply.

REPT

Established: 2017

REPT mainly focuses on producing prismatic aluminum ternary lithium batteries and iron lithium batteries of VDA and MEB standard sizes. REPT has two bases, the Wenzhou base, and the Shanghai R&D center, with a current production capacity of 26GWh.

Regarding production and capacity planning, REPT has deployed manufacturing bases of power and energy storage batteries in Wenzhou, Foshan, and Liuzhou, Zhejiang.

Among them are the Foshan base 30GWh, Wenzhou Phase III 100GWh, and Liuzhou base 20GWh. It is reported that REPT’s production capacity will reach 200GWh in 2025. In May 2022, the installed capacity of REPT is about 0.22GWh, with a 1.19% market share, ranking tenth in China.

In terms of customers, in addition to SAIC-GM-Wuling, the main customers of REPT include Dongfeng Passenger Cars, Sungrow, etc., and designated customers have PSA, FAW, Geely, etc.

Conclusion

China’s power battery market is set to accelerate growth with the fast rise demand for electric vehicles, the industrial chain return to normal gradually, and the effective control over the epidemic, which will see nearly 300 GW of battery storage capacity installed in 2022. However, the increased demand also means greater competition. The power battery race has just started.